SO, WHAT’S CHANGED?

The problem is that the British economy is weak. Britain invest less than its major competitors and tends to favour low-risk investment…With a weak capacity to lift production, the economy quickly runs into bottlenecks in economic upturns, with one sector or region overheating before the rest. But the rate and character of investment in the real economy is closely related to the contract-based financial system, which is almost wholly organised around a system of highly ‘liquid’ markets, providing investors in other words with the chance to recoup any commitment they have made quickly and turn into cash by selling. The financial markets undervalue future profits and encourage the takeover of a high proportion of UK companies, while British banks tend to lend short-term. The cumulative impact on the real economy is marked. Contract capitalism is proving as destructive here as in the labour market.

Will Hutton 1997

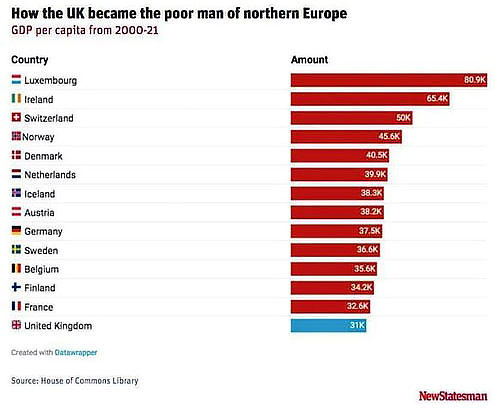

As a social democrat and long-time Labour supporter I wonder how the new government is going to grow the economy (to required levels to fund the many investments that need to be made) without membership of the EU or at least by joining the Single Market and Customs Union (with its 500 million market on the UK’s doorstep, and the key to past growth). Despite the clearest data that signifies this, the Labour leadership declares that while it will seek to improve EU relationships it will not seek to rejoin these critical associations. This represents extreme stupidity and incompetence, and the EU will not accept a piecemeal approach without a firm commitment to fundamental rules and beliefs.

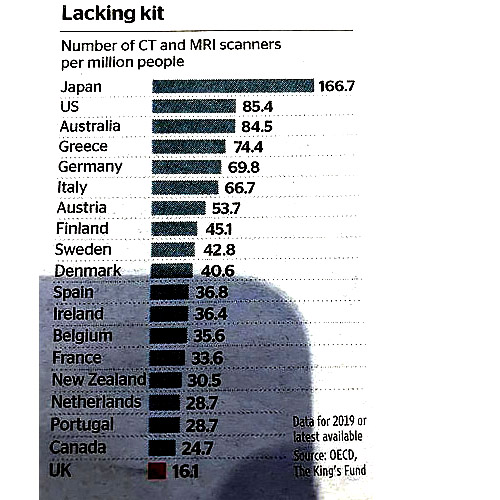

The Labour government is shocked to find, “a black hole of over 22 billion.” If only! The real value of the black hole is many times more than 22 billion. Let me explain: every major public service is in crisis including the NHS, the Justice System, Policing, Social Care, Local Councils (who are obligated to supply some vital local services), Education, Social Housing and more. To bring these services even to basic competence will need many billions more than 22 billion. The Prime Minister has just stated that the NHS needs long-term reform while understating its need for much more money. How then can the NHS been brought up to the standard of the health services of other developed nations? We already know that UK NHS equipment levels (scanners etc.) are well below countries like France, Germany and Italy. To lift the technological contribution will also need substantial funds. The NHS also suffers from critical staff and skill shortages aggravated by leaving the EU. Yes to Reform but an even bigger Yes to Investment. How will Fiscal Rules help in solving these problems with the certain prospect of medium to long-term low economic growth? When the Conservatives dropped National Insurance contributions twice, Labour agreed. At the time I noted that this made no sense in an environment of desperately needed investment. These moves should have been vigorously opposed but were not.

The Labour party’s election mantra was ‘change’. But as is already becoming obvious, little changes.

New Labour has won support because of the electorate’s sheer weariness of a party that has governed for so long, and partly because it has attempted to reshape its policies within the prevailing Conservative ethos - while preserving as far as it can its own historic objectives. So far it has been a successful strategy. But it is dangerous too. For the current position is unstable. Unless an ascendant body of ideas can be assembled, underpinned by a political philosophy that incorporates a different worldview and policy direction, Labour will find in office that it governs as a nicer group of Conservatives. This will legitimise the right and so encourage it to move further to the right, even as Labour’s own political position becomes more threadbare. Worse, given the scale and nature of Britain’s economic and social problems, the risk of failure is high.

Will Hutton THE STATE TO COME. 1997

The Past and Future

The real UK decline started with Mrs Thatcher with deindustrialisation, the bias towards the financial industries and deregulation, emphasis on the individual and downgrading of the importance of society, the anti-EU seed sewn in the Conservative party, and the right to buy scheme that robbed the country of over a million affordable council rental homes. Then, in later years, the austerity measures adopted by Cameron and Osborne which effectively dealt a death blow to all the major public institutions and, in my opinion, will be virtually impossible to return to good health. Since Thatcher the rich have become richer and the poor have become poorer, while the middle classes have begun to experience problems through the cost of living, high mortgage and rental increases and increasing job insecurity.

The UK taxation system is no longer fit for purpose - it’s far too complicated and concentrates on taxing earned income while allowing unearned income to escape virtually unscathed. The standard of living for most has declined for many years highlighting the plight of the young against the relative financial advantages of the much older generation. Nothing is working. The new government should be considering what amounts to a revolution starting with the electoral system and ending with a return to EU membership (or at the very least membership of the Single Market and Customs Union). In between these major subjects it must face up to the challenges of Social Care, Housing, Environment, Poverty, Policing, Education, Taxation and much more.

Thus far I see no sign that Labour will attack these problems with the force and veracity required. I’m worried over the seeming lack of knowledge and awareness of the critical problems that exist and affect most of the UK population. I am also concerned that the support for Israel is ‘iron-clad’ with only minor support for the plight of Gazans. I am also aware that we seem to be still clinging to USA coat-tails and following the country’s lead especially in finance (one of the major errors of previous right-wing governments). The banking sector is still failing to provide the long-term finance that business requires which still relies on funding from shareholders whose real goal is short-term return. Pension companies hold a substantial portion of their capital in shares, mainly in overseas companies, with too little invested in UK companies.

|

Europe |

LATEST GALLERY IMAGES

Elliot Minor

Charity Workers Massacred |

|

|